Manage your Sacco or Micro-finance bank with ease using Franktek Microsystems™ Sacco software in Kenya. Our Sacco software application has the following features:

•Cloud based – the software runs on the cloud but its a desktop application, so you can manage your Sacco with ease even if the offices are in different geographic locations.

•Supports unlimited offices including one Head office and additional branch offices.

• Unlimited system users(clerks, loan officers, Sacco software system managers) and merge them into any of your desired offices.

• Unlimited product categories (e.g. Development loans, Emergency Loans e.t.c, Personal Savings e.t.c)

• The Sacco software in Kenya has dynamic charges(Fees and penalties) e.g. Sacco Membership fee, late lateness penalty, monthly ledger fees, weekly, bi-weekly and monthly loan fees e.t.c

• Create unlimited Shares products e.g. you can have ordinary shares and special shares for members each with different face value/current prices.

• Create Unlimited Savings products with our Sacco management software– you can define different savings products depending on your Sacco portfolio. You can also set dormancy period, interest rates, Minimum withdrawal, and maximum amount per each withdrawal.

• Create Shares Products – define shares products and set the face value, shares current price e.t.c

• Create an unlimited number of loan products: Create different instances of loans. For instance, you can set your Sacco to have different loan products with varying repayment periods, interest method(flat, reducing balance), interest rates and min/max loan amounts

• In addition, the system allows you to suspend accounts and will also automatically change accounts to dormant or late (in case of loans) depending on your settings.

• View a snapshot of your Sacco via the dashboard and grasp the number of clients, shares net worth, savings balances and loan balances in real-time.

• You can also generate Savings, Shares and Loan statements as well as many sacco accounting software reports with a single click of a mouse.

Interested in a Sacco management software free download? Just call us on +254727337512 for a free demo

Screen Shots

Visitors

Sacco software in Kenya

Since its creation, Franktek Microsystems Sacco Software is one of the best Sacco software in Kenya that assists Microfinance institutions to automate their banking operations. Our software has most of the features needed by microfinance banks that want to manage clients, create shares accounts, savings accounts and offer loans.

Cloud-based Sacco software in Kenya

Our bank software is cloud-based eliminating all the hassles and heavy costs associated with WLAN. The system relies on a remote and 24/7 reliable MySQL database in secure data centers making it the most stable Sacco management system to be built. Cloud-based banking software applications are the future of the banking industry especially those with different branches located in various geographic regions. We have also combined the power of the cloud with an intuitive desktop User Interface. After heavy research, we found that software applications that run from the browser are slow and unpredictable. This is why we went a step forward to make a very attractive desktop app that can talk to the core banking database in real-time.

Understanding the Microfinance software Research

Managing microfinance clients, shares, savings, and loans is a very easy task if one understands the basics of doing this. Let’s document some of the things that Sacco managers need to know. Or if you are planning to become a leader in a Sacco, here are some of the things that you need to know.

Microfinance Bank Offices

Every microfinance institution can have one or more different offices. These are sometimes called branches. One of the offices is referred to as the Head Office while the others can be purely termed as branch offices. So, in our Sacco software, we allow Microfinance managers to define at least one head office and additional branch offices.

Sacco application System Users & Roles

Microfinance institutions have different users that run the organization. These are just employees who are given the right to access the microfinance software functions. The users are usually classified into roles. Roles define what a user can do and what they can’t. For instance, Sacco can have 3 users namely: John, Peter, and Mary. John is the manager of the Sacco while Peter is the Loan officer and Mary is just an office clerk. Roles in Sacco software application are very important because they are the bank to have complete control of the employees in regards to the tasks they can accomplish in a system to avoid compromising the security of the system or manipulation which can lead to theft of customers/clients funds.

Sacco Portfolio Management

Sacco Product categories and Products

Think of a Sacco or a microfinance bank as a shop. This shop wants to serve some customers. The customers here are known as the client. Now, for the bank to serve the clients, it must have some products e.g. shares products, savings products, and loan products. On the other hand, the bank must classify these products into categories.

This is the same case in shops/supermarkets, you just enter the store and you can see different categories like clothing, household items, and electronics e.t.c. So, in simple terms, a microfinance bank must define the different categories and list the products to be offered in each of these categories.

To put this in a better perspective, here is a sample portfolio of a Sacco. You can see all these by requesting us a Sacco management software free download

- Shares Categories: Ordinary shares, Gold Shares

- Savings Categories: Personal Savings, Business Savings

- Loans: Personal Loans, Business Loans

So you can see we have got different categories, next we can define products that we will offer in each of those categories. For instance, we can create a product called Member shares and map it to the Ordinary Shares Categories.

Also, we can create a saving product in the Sacco software in Kenya and merge it to Personal Savings e.g. Instant savings product. The same goes for loans. We can create a loan product called Emergency Loans and merge it into Personal Loans categories. This is pretty easy using Sacco Software

Microfinance bank charges

Referring to our example above, microfinance institutions are like shops, however, they don’t make a profit by selling fruits, vegetables, or electronics. However, they need to get some profit and even pay dividends to investors.

To achieve this, Microfinance banks raise their profit from charges. This simply means fees and penalties levied on clients and the different products that we saw above. Charges(fees and penalties) can be charged from the client level, in a shares account, savings account or in loan accounts.

Here are some of the charges that microfinance bank can collect:

- Clients: Client registration fee, client penalties (lateness, absenteeism in meetings), client monthly fees e.t.c

- Shares: Shares first time purchase fee (activation fee), share purchase fees(in subsequent purchases), shares redemption fees

- Savings: Savings account opening fees, saving account activation fees, saving withdrawal fee, savings account transfer fee, saving account closing fee

- Loans: Loan application fee, weekly, bi-weekly or monthly loan fee, loan penalties(in case of default installment payments).

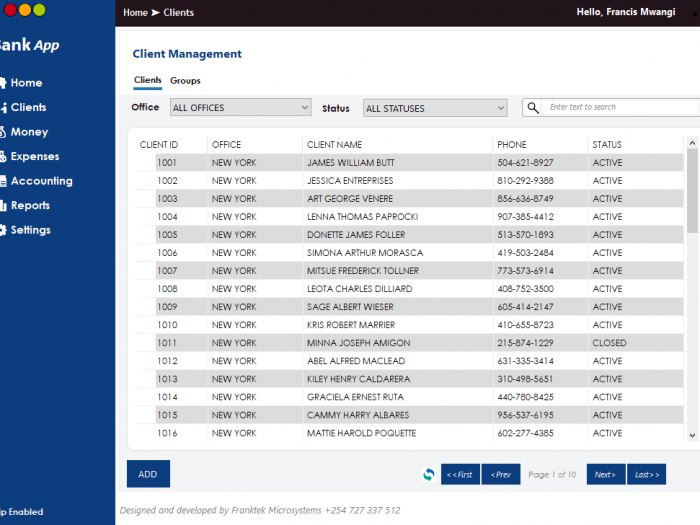

Summing things together

So we now have a complete microfinance bank or Sacco that has got different offices, system users classified with roles plus some products, and a way to get profit from clients through fees and penalties (charges). The next step is to come up with customers or clients and create a database of them; this is pretty easy if you are using a Sacco software application like our Franktek Microsystems Sacco Software.

Creating Sacco Clients

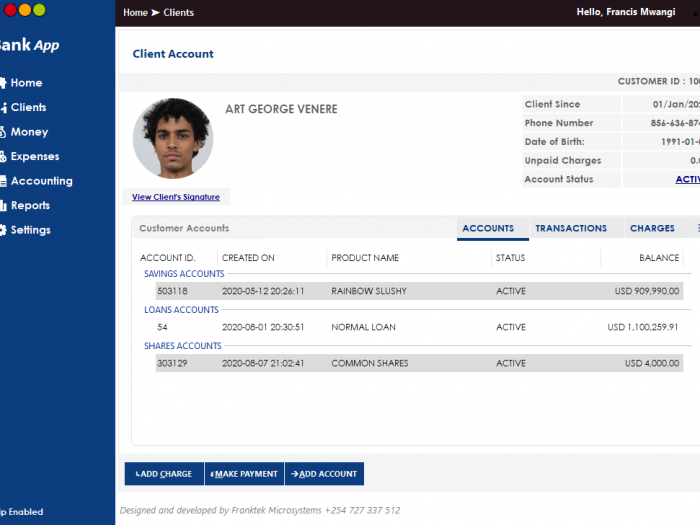

- Each client should have a different ID known as client Id or customer id, if you are using a system, this ID is allocated automatically

- It is advisable to collect the full names of a client together with the postal address and physical living address

- Also, take note of the client mobile number especially if you will be sending text messages to inform clients about meetings, their account status either manually or through a Sacco accounting software

- Record the details for the next of kin.

- Also, do take a copy of an identification document used by the client as well as a signature specimen and a passport photo.

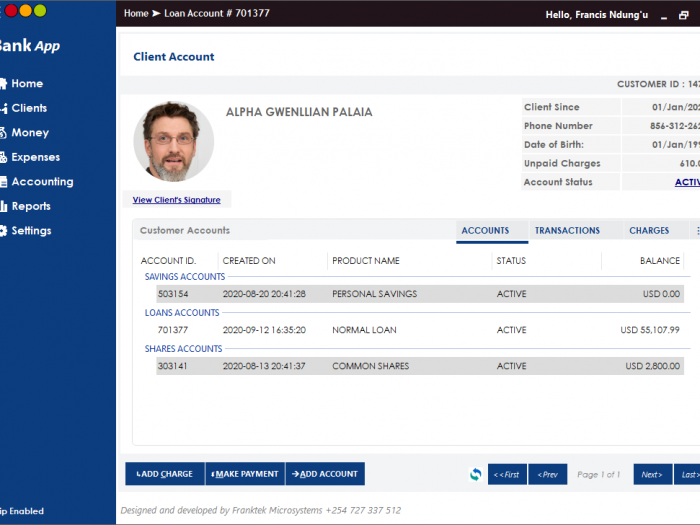

Associating Clients to different Accounts (Shares, Savings, and Loans) in Sacco software in Kenya

The client id is very important in any Sacco software system because it allows a microfinance institution to merge all clients’ accounts into one group. For instance, if you create a client know as John James with client Id 1001, you can go ahead and create savings accounts and associate them with the same account. Remember, a client can have as many accounts of savings, shares, and loans and all of them must have different account numbers.

Taking our example above, if John James has a client ID 1001, he can have a savings account with id 10002211, a share account with id 20001100, and a loan account with id 200100100. Please note, when a loan is fully paid, the account id cannot be reused and a client should get a new loan account number after a new loan has been approved and issued. Our Sacco accounting software takes care of this

A manager of a microfinance institution should come up with a better numbering of the accounts to avoid conflict. Normally you can start clients’ id with a number like 1001, shares account with a number like 3000127, savings account with a number like 5000127 and loan accounts with a number like 7000127. This way, the number will never overlap and this minimizes confusion. If you are using our Sacco management software, all this will be done automatically for you. Just request a Sacco management software free download demo to see this in action.

Special Notes about Shares Accounts

Shares accounts in the Sacco software in Kenya rely on information from shares products e.g. Price per share. A microfinance institution can set the price per share e.g. Kshs. 1.50 or Kshs. 1000 depending on what they want. This is known as the face value of the share. However, the figure can change with time but the newer values are known as current prices

Special Notes about Savings Accounts

Savings accounts rely on parameters created on savings products such as dormancy period, minimum balance, and maximum withdrawal amount. Once a saving account is created, it can accept deposits (money in) and withdrawals/transfers (money out). Also, charges reduce the savings account balance. In some microfinance institutions, savings account do earn interest, this can be calculated daily or monthly and then posted to the client’s savings account either on a monthly, quarterly, semi-annually, or yearly basis. Franktek Microsystems Sacco software does all this hard work for you automatically.

Special Notes about Loans account

Loan accounts take the parameters defined when creating loan products. These include interest calculation type(flat or reducing balance), min and max allowed amount, min and max interest rate plus min, and maximum repayment periods. Also, loan products can be defined to waive penalties when the Sacco client pays early. This should be effected by reducing balance loans to encourage early payments and reward loyal Sacco customers who pay their loans early.

Also, loan payments should be collected against a repayment schedule starting from penalties, fees, interest, and lastly principal. Our Sacco software application does this for you without any errors

Income Report in Sacco software in Kenya

Finally, we have set up our microfinance institution with every that is required. Finally, we need to sum up the income at the end of the accounting period and see how the Sacco has been doing. This is pretty simple. We just need to sum up the following either manually or using a Sacco software system:

- Client charges

- Shares account charges

- Savings account charges and

- Loan charges

- Loan interest income

Then we need to minus the following

- All microfinance expenses

- Any savings interests posted to savings accounts

- Written off loans

And at last, we get our microfinance bank profit. If you are happy reading the information, why not get in touch with us and get as Sacco management software free download to automate your microfinance bank. This is the best Sacco software in Kenya.